Oborevwori identifies threats to ease of doing business in Nigeria

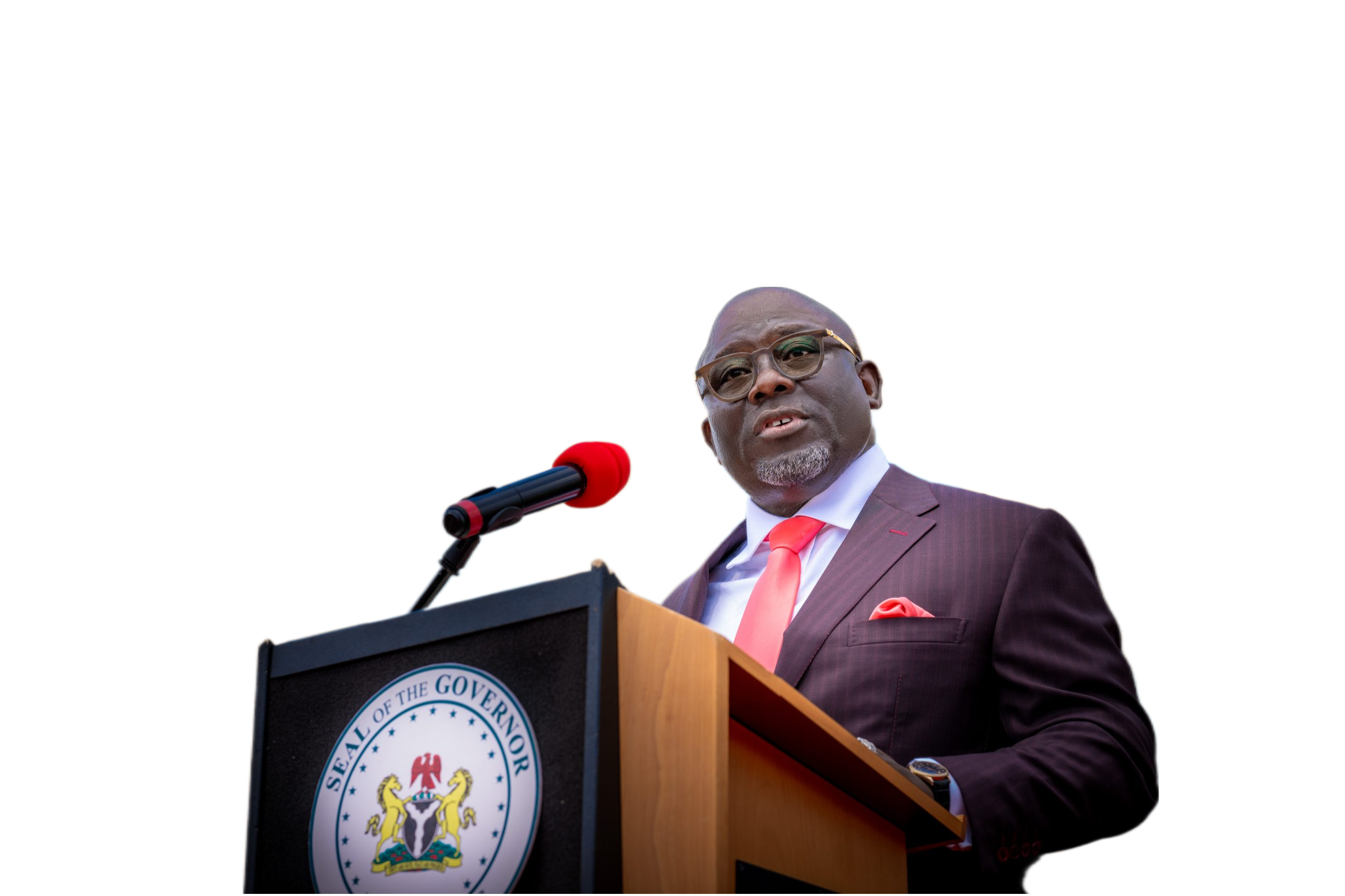

Delta State Governor, Rt. Hon. Sheriff Oborevwori, Monday, identified harsh and hostile operating environment, poor basic infrastructure, insecurity and policy flip flops as disincentive to both local and foreign investments in Nigeria.

Governor Oborevwori also remarked that the nation’s tax to GDP ratio was low because of harsh operating business environment and called for the removal of institutional bottlenecks to the ease of doing business in the country.

He stated this in his keynote address at the 2023 Federal Accounts Allocation Committee (FAAC) retreat with theme: “Creating a resilient economy through diversification of the nation’s reserve base” held at the Events Centre, Asaba, the Delta State capital.

Represented by his Deputy, Sir Monday Onyeme, Governor Oborevwori frowned at the non commital of the CBN to be responsive to the clarity and correctional demands made to it by FAAC, in relation to the management of the Federation Account.

He also called on the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) to quickly verify the data earlier submitted by the three tiers of government.

According to the Governor, Nigeria’s tax to GDP ratio is comparatively low, about 10-12%, which makes the country vulnerable to disruptions in the global economy.

“A strong, resilient, and competitive economy, requires a flourishing private sector. But there are problems. Structurally, the private sector is largely weak, unorganised, and challenged.

“The operating environment is harsh and hostile to the ease of doing business. Poor basic infrastructure such as electricity, water, transportation, security, are strong disincentives to investments, local or foreign.

“Also, frequent policy flip flops and an inefficient bureaucracy are anything but helpful to the ease of doing business in Nigeria,” he stated.

While commending members of FAAC for their commitment and dedication to duty and for the correction of wrong computations and refunds to oil producing states of the Federation, the Governor added that much work still needs to be done on the payments of 13% derivation, since the coming into force of the Petroleum Industry Act (PIA).

“Since the implementation of the PIA, a lot of concerns have been raised by stakeholders of this sector in respect of the new roles of the Nigeria National Petroleum Company Limited (NNPCL) as it affects inflows of revenue into the Federation Account. It is my hope that this retreat will address these concerns and lay them to rest permanently.

“Tax is the dividend of a thriving private sector. For us to reap the benefits, we need to, as a matter of exigency, remove the institutional bottlenecks that make the cost of doing business in Nigeria unbearably high.

“It is only after we have done this that we can realistically expect to widen the tax base and diversify the economy. It is inevitable that where the cost of doing business is frustratingly high, tax evasion and tax avoidance will be pervasive.

“In conclusion, it is my considered view that the issue of economic diversification must move beyond rhetoric.

“Concrete, measurable steps need to be taken now to facilitate non-oil exports, expand the revenue base, and make economic diversification a reality.

“Here in Delta State, for instance, we have created a Trade and Export Unit to drive the process. Let me also stress that in seeking to facilitate the growth of non-oil exports as canvassed, there is a compelling need to ensure that the oil and gas sector is consistently operating at its optimum,” Oborevwori said.

Earlier in his welcome remark, Minister of Finance and Coordinating Minister of the Economy, Chief Olawale Edun, represented by the Permanent Secretary, Special Duties, Federal Ministry of Finance, Mr. Okokon Ekanem, appreciated Governor Oborevwori and the Delta State Government for accepting to host the retreat.

He said in six months of the Bola Tinubu administration, the nation had witnessed important reforms such as Petroleum subsidy removal, fiscal and monetary policy reforms aimed at removing multiple taxation, streamlining and simplifying tax administration as well as achieving single foreign exchange market.

He said the reforms have gained commendations not only by experts in Nigeria but by the international development partners such as the International Monetary Fund, the World Bank among others.

“We believe these reforms are what Nigerians need at this point and we are on course to achieving the objectives of these reforms.

“The Federation Account is witnessing improved revenue inflows since the removal of subsidy from the average of N650 billion monthly to over N1 trillion in the last four months.

“Government has long realised that Petroleum subsidy is unsustainable giving that erodes revenues that should have been used to fund viable expenditures that are critical to the well-being of the populace.

“As we continue implement our policies, we will remain mindful of the needs and welfare of Nigerians.

“We all know that achieving tax revenue to GDP target of 22 per cent and tax to GDP of 18 per cent by 2026 are part of the terminal objectives of this administration.

“However in doing that, we appreciate the need not to overburden the tax payers by introducing so many new taxes. What is necessary to be done is to broaden the tax base, simplify and streamline tax administration for ease of collection,” Edun stated.

The retreat is being attended by Commissioners of Finance, Accountants-General of States, NNPCL, Revenue Mobilisation Allocation and Fiscal Commission, Federal Inland Revenue Service, Customs and other revenue generation organs of government.